COVID-19 is having a significant impact on digital marketing, ecommerce, digital media, and other important aspects of our lives and businesses. Here is a running list of stats that I will update over time as new reports are released:

SPENDING ATTITUDES

Canadians are being more mindful of where they are spending their money during COVID (McKinsey).

SPENDING PATTERNS

15% of Canadians say they've added a streaming service, such as Netflix, Disney+, or Crave, since the COVID-19 pandemic started (Forum).

Ride-sharing in Canada has decreased by 50% during COVID-19 (Forum).

ECOMMERCE ADOPTION

Year over year, Canadian e-commerce sales more than doubled during the pandemic—with a 110.8 percent increase compared with May 2019 (StatsCan).

79% of Canadian adults spent 20% or less of their total shopping budget online prior to the pandemic, but 38% say they plan to spend greater than 20% after COVID-19 (Forum).

RETAIL IMPACT

While Canada's retail sector is expected to shrink by 6.2% overall as a result of COVID-19, ecommerce share of retail sales is expected to rise to 8.7% in 2020 (StatsCan).

Retail e-commerce sales reached a record $3.9 billion in May, a 2.3% increase over April and 99.3% increase over February to $2.0 billion (StatsCan).

SEARCH BEHAVIOUR

60% of Canadians used search during the pandemic to see “what is open or closed near me” in April 2020 (Google).

SHOPPING INSPIRATION

Digital channels are a key trigger for finding new places to shop, 63% of Canadians use digital as a source of insight (McKinsey).

ONLINE SELF-SERVICE

68% of Canadians have tried a new shopping behaviour during COVID (McKinsey).

Consumers have adopted contactless self-serve habits that they intend to continue even after the pandemic (McKinsey).

AMAZON PRIME

49% of Canadians that work from home have an Amazon Prime account vs. 30% of Canadians that do not work from home (PWC).

OFFLINE SHOPPING

Only 63% of Canadian adults are likely to shop in a mall if available and permitted to do so in 2020, and only 18% are likely to attend a live sporting event (PWC).

36% of Canadians are using self-checkout in offline retail, in part to limit physical contact with other people (Deloitte).

Only 7% of Canadians agree that shopping for groceries online is easier (Deloitte).

AT-HOME ACTIVITIES

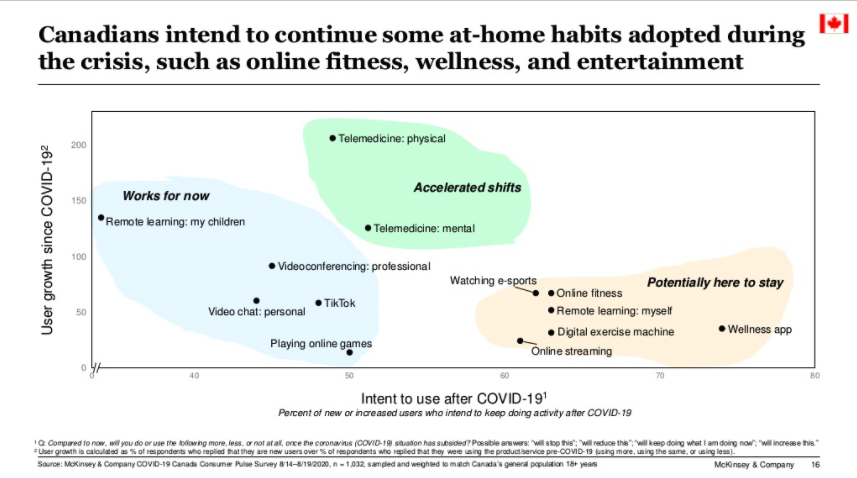

Canadians have adopted new digital and low-touch activities, including curbside pickup, video chat, and telemedicine (McKinsey).

Canadians intend to continue some at-home habits adopted during the crisis, such as online fitness, wellness, and entertainment (McKinsey).